Orange County — The changing lifestyles of baby boomers and millennials, increasing foreign investment and decaying roads and bridges are among the top issues facing commercial and residential real estate in the coming year, the head of a national organization of leading real estate professionals said Wednesday.

Global instability and an expanding wealth gap also can disrupt real estate markets, said Grant Gerhart, Managing Broker of the Integrated Realty Group, Inc.

“This list reflects a higher degree of economic uncertainty than in years past,” Gerhart said.

Those uncertainties include expected interest rate hikes, currency devaluations overseas and a growing wage gap, he said.

Here then is Gerhart’s top 10 list:

- Demographic shifts: Boomers and millennials will have the greatest impact on real estate. Boomers are expected to downsize or move into senior communities. Millennials, meanwhile, are postponing home buying over renting, preferring to live in more urban, walkable communities.

- Excess capital: Foreign investment is approaching record highs as countries with high savings rates continue to see the U.S. as a safe haven for their cash. Apartments are a favorite target, but investors increasingly see homes as a secure asset.

- Rising interest rates: Still at historic lows, mortgage rates are expected to start rising again in the near future, slowing real estate sales and price appreciation. Rate increases, however, could spur home sales as buyers jump in before rates go too high.

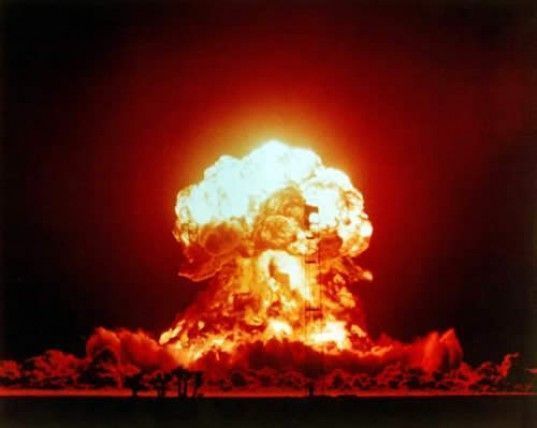

- Global instability/currency devaluation: Flare ups caused by Greece’s debt, the Ukraine, the Mideast and cyber security troubles could disrupt the real estate recovery. Meanwhile, currency devaluations are impacting many other countries, which in turn, has boosted the strength of the dollar.

- Urbanization: A growing demand for live-work-play communities is affecting housing choices and could reduce demand in the suburbs. Corporations will follow residents back to the cities, choosing to locate where the workers are.

- Oil price drops: Real estate is suffering in areas where oil production is highest. This, however, is not a big factor in Orange County.

- The gap between rich and poor: Because income inequality is widening, purchasing power and homeownership is falling, especially for millennials and some immigrant groups. A shift towards renting over homeownership and a decline in locally owned small businesses increases the potential for social unrest.

- Infrastructure: The condition of U.S. roads, bridges and utilities lags that of other countries, and public funds to fix them are limited. That hampers development. People also are reluctant to move to areas with long commutes on congested or dilapidated roads.

- Real estate technology: Tech improvements are speeding up transactions and dramatically changing how brokers do business.

- Online shopping: Store sizes are shrinking as they become showrooms where people can go to try out or try on products before buying them online. Online shopping is shifting demand from suburban-style malls to urban-like shopping and entertainment centers. From 10 percent to 15 percent of malls “are functionally obsolete.”

Contact us at Integrated Realty Group for more answers to your Orange County Real Estate questions.