You will bump into a wide variety of concepts in the world of rental properties, and yes, sometimes they can be too hard to digest, more if you’re barely getting ahold of it because you need to sell, rent, or find a new property. Real estate investors might be the only ones that fully understand this complex combination of terms, but if you want to be up to date with at least the basics of rental property, you’ll find that the term “good cap rate rental property” comes out a lot; what is it? How to calculate it? Those and other questions are approached in this article. Here is the basic information for a good cap rate on a rental property you need to know.

What is Cap Rate?

Cap rate is all about Return on investment (ROI), which measures the rental income generated by income properties, their prices, and their operating and rental expenses, all of this to get the most accurate measure of a property’s profitability. The return on investment can be measured in two ways: cash on cash return and through cap rate.

Cap rate, short for capitalization rate, is a return on investment measurement of rental properties regardless of how they were financed. The cap rate is based on the rental income, rental expenses, and value of a rental property. Naturally, this tells real estate investors how much profit they’re receiving out of the property’s value, and it will always be expressed as a percentage. The capitalization rate is highly important to make money in real estate, regardless of the rental strategy.

How to Calculate the Cap Rate?

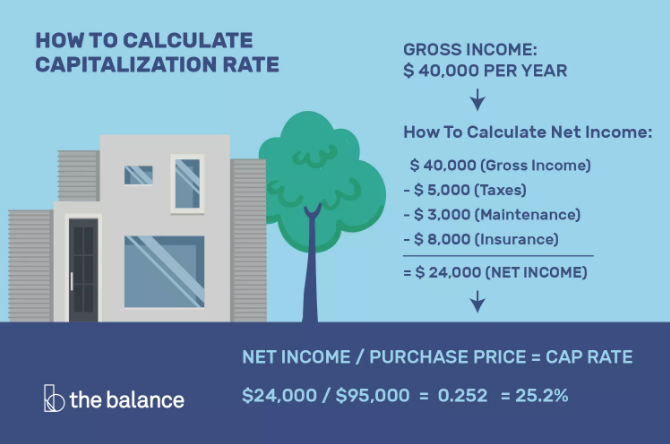

The capitalization rate is calculated with the net operating incomes and recent sales prices of comparable properties. The first thing you need to do is get the recent sales price of a similar income property, then determine the net operating income of that property and finish by subtracting all operating expenses except the mortgage. Here’s an example from The Balance, which can help you with the calculating cap rate formula:

If this is hard to swallow then stop worrying, as you can calculate the cap rate in this calculator.

What Affects a Good Cap Rate?

As with most properties, location still impacts the value of what you’re selling, renting, or buying; this is why the rental strategy can change the range of what is a good cap rate. For instance, Airbnb rentals tend to generate higher rent compared to traditional rentals, while these, on average, cost less in the rental expenses. Cases like these can make the range of a reasonable cap rate differ depending on the rental strategy. Another factor that’s involved in the outcome of a good cap rate is the property type, which means that multifamily rentals can have higher cap rate than single-family homes; also, ranges can vary from long-term to short-term rental properties.

Why is Cap Rate so Important?

The three main reasons are the return on investment, the comparing of investment properties, and the estimated payback period. The cap rate is one of the forms of return on investment (ROI), as real estate investors need to determine how profitable the income of your property is. Comparing investment properties is essential to distinguish between investment properties based on expected profitability. Finally, the estimated payback period is needed so you can know if the cap rate will fully cover the property payment. How do you estimate the payback period? You only have to divide 100 by the cap rate of the property; for example, if the payback period of the property is 12 years, the formula is 100 divided by 12.

The world of real estate is a bit confusing, but once you start going deeper into concepts, there may be a chance you can have it all under control. In case all this still turns your head into a mess, don’t hesitate to call agencies that help you manage your property or guide you through the process regarding any type of property.