Well, credit standing is one of the most important things lenders want to look at before you’ll get qualified for financing with Laguna Beach Real Estate. While credit score is certainly not the only factor lenders want to consider, it plays an important role in determining your capacity to pay the mortgage payment. A good credit score is your ticket towards receiving a cheaper home interest rate. Nowadays, a credit score of at least 620 will qualify you to obtain a decent mortgage interest rate accompanied by your amount of savings and good income level.

Most buyers are entering into the housing market right now because of the cheap mortgage rates, and some of which are even lower than 3%. When you decide to buy a house, you don’t need to only determine whether you are financially able or not, but also, you need to make sure that your credit rating is in good shape.

While many buyers think that the additional percentage point will not make any difference on the interest rate, it does. A lower interest rate will have a significantly lower monthly mortgage payments. This helps buyers free up some cash every month. Whereas, if you don’t have a good credit score, you’ll be paying higher interest rates monthly and you are going to pay costlier monthly dues.

This is why, it is important for home buyers to know their credit scores and restore the perfect credit before applying for home mortgage. The following are what potential buyers want to know about credit score.

Knowing Your “Credit Score”

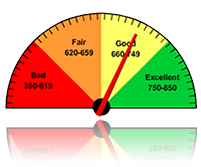

Credit scores range from 300 to 850, where 300 is poor and 850 is excellent. Credit scores are calculated by looking at certain factors.

The following are the five factors to have a perfect credit score:

- Past payment summary – 35% of a score is determined by this factor. If you pay your bills on time, the higher your credit score will be.

- Amounts owed – consumers who have used up a large percentage of their credit, usally they don’t want to see more than 25% of your credit used on each credit card. Example if you have a $5,000 credit limit your average monthly balance doesn’t exceed $1,250. This will take up 30% of the total credit score.

- Credit length – 15% of the total score will be determined by the length of time a consumer has had the credit. The longer a consumer has credit history, the better.

- New credit – 10% of the score will be affected by new credits. If a consumer opens up a lot of new credit at once, it will hurt their total credit score.

- Type of credit – 10% of the total score will be determined by the type of credit a consumer has. If a consumer has a variety of credits like credit cards, retail accounts and instalment loans, they tend to boost credit rating.

So, the higher the buyer’s credit score, the lower the interest rate. Though there are other factors besides credit score, like down payments, that are used when determining an interest rate.

Remember that there are several types of credit scores and your lender would like to consider a credit rating that is specifically geared towards home loans. We are always here to help at Integrated Realty Group.